The Numeric Asset Aggregation Ledger, encompassing assets such as 911199923 and 914539300, exemplifies a sophisticated approach to asset management. By employing unique identifiers, it facilitates precise tracking and accountability. This structured method not only enhances transparency but also bolsters security across financial systems. As stakeholders navigate a rapidly evolving landscape, the implications of these advancements warrant further exploration, particularly regarding their impact on investment strategies and institutional operations.

Understanding Numeric Asset Aggregation Ledgers

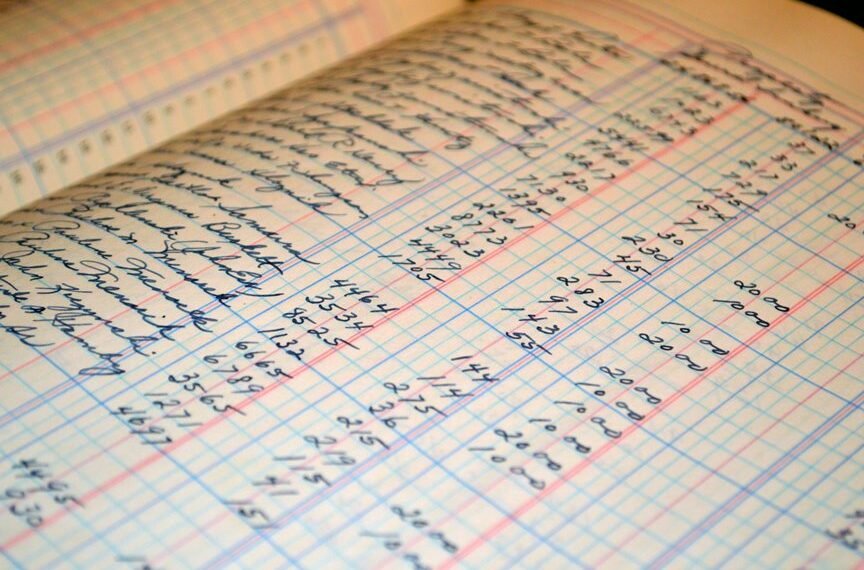

Although the concept of numeric asset aggregation ledgers may seem complex at first glance, it fundamentally serves a critical role in modern financial systems.

These ledgers utilize aggregation techniques to compile numeric asset data, ensuring comprehensive visibility. Through advanced ledger technology, stakeholders benefit from enhanced data standardization, promoting accuracy and efficiency.

Ultimately, this framework empowers individuals with the freedom to manage assets more effectively.

The Role of Unique Identifiers in Asset Management

Unique identifiers play a pivotal role in the realm of asset management by ensuring that each asset is distinctly recognized and easily traceable within a numeric asset aggregation ledger.

These identifiers facilitate efficient tracking, promote accuracy in reporting, and enhance accountability.

Benefits of Enhanced Transparency and Security

Enhanced transparency and security within a numeric asset aggregation ledger provide significant advantages for asset management stakeholders.

Improved transaction visibility fosters trust among participants, while risk reduction measures enhance overall safety.

Accountability enhancement ensures that stakeholders can track and verify actions taken within the ledger, reinforcing regulatory compliance.

Collectively, these benefits empower stakeholders to operate with greater confidence and efficiency in their asset management endeavors.

Future Implications for Investors and Financial Institutions

What might the future hold for investors and financial institutions in light of advancements in numeric asset aggregation ledgers?

Enhanced data analytics will revolutionize investment strategies, allowing for more tailored approaches.

Furthermore, improved risk assessment frameworks can lead to more informed decision-making, fostering greater confidence among stakeholders.

This shift could ultimately empower investors, driving innovation and promoting a more dynamic financial landscape.

Conclusion

In conclusion, the implementation of Numeric Asset Aggregation Ledgers significantly enhances asset management by providing unique identifiers for precise tracking and reporting. This advancement not only fosters accountability among stakeholders but also ensures robust transparency and security. Notably, a recent study revealed that organizations leveraging such advanced ledger technology can reduce operational costs by up to 30%. As financial institutions increasingly adopt these systems, the future promises greater efficiency and innovation in asset management practices.